How Open Marketplace Infrastructure Can Drive Growth and Innovation in Private Markets

Sep 5, 2023

Private Asset Investing Desperately Needs New Market Infrastructure | Bain & Company

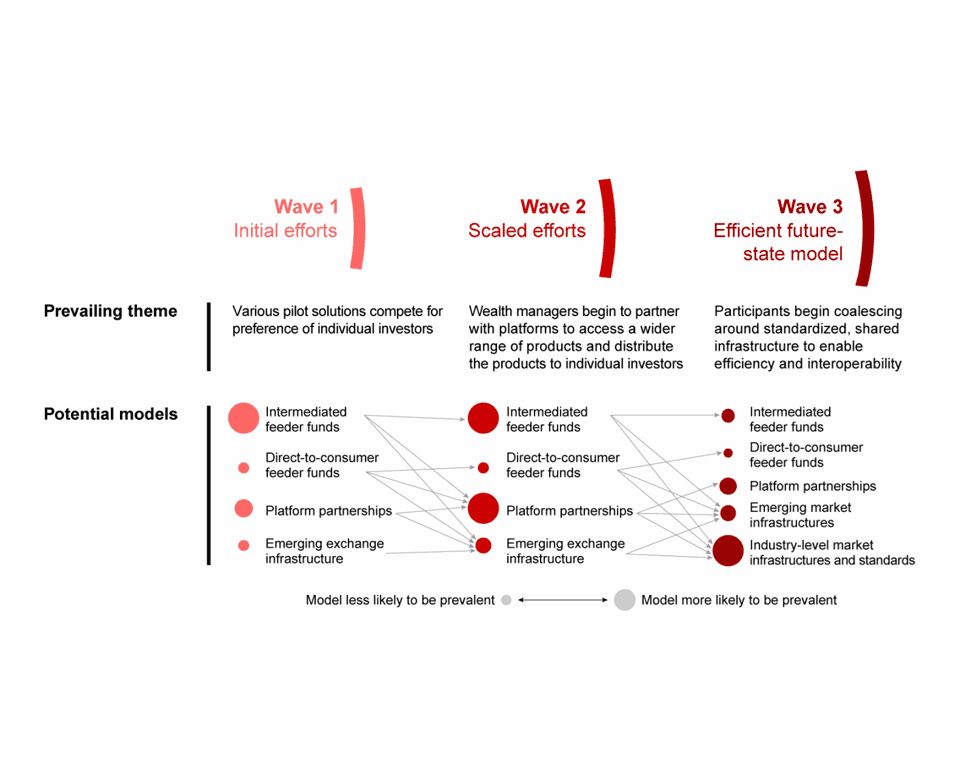

In a recent article from consulting giant Bain & Company, Thomas Olsen and a number of other reputable authors discuss Bain’s outlook on private market innovation over the coming years. Private markets today are on the precipice of massive innovation, as demand from mid to high net worth investors for access and more liquid trading solutions has sparked a secular shift. “But while individuals account for just 16% of such (private) assets globally, they hold roughly 50% of global wealth. About 38% of high-net-worth individuals and 53% of very-high-net-worth individuals would like to increase their allocation of private alternative assets (Bain & Company).” Mr. Olsen identifies a number of areas in private markets that are ripe for innovation to help solve both access and liquidity problems. Olsen examines four existing market solutions driving access and liquidity in private market investing: intermediated and direct to consumer feeder funds, platform partnerships, and emerging marketplace technologies. The solutions, shown in the chart above, provide a helpful framework for thinking about the plethora of funds, platforms and technologies all providing different levels of access to private markets.

Intermediated feeder funds are focused on providing access to investing with specific asset managers. Wealth managers and individual investors can allocate capital to managed funds, relying on the track record of the asset manager in making investment decisions. Moonfare is a good example of a technology platform enabling investors to access high quality funds/fund managers through a feeder fund structure. Direct to consumer feeder funds allow individual investors direct access to private market funds. For example, Securitize has used blockchain technology to distribute KKR fund units to individual investors. In the platform category, two different segments of online platforms have emerged, investor driven and wealth advisor driven. Fractional real estate platforms like Arrived Homes cater to retail non-accredited investors with $100 minimums, while platforms like Crowdstreet appeal to the individual investors who are of accredited status and up. Both platforms offer individual investors access to private alternatives. On the wealth advisor side, iCapital and CAIS provide the wealth management and advisor channel with access to a technology enabled platform, to invest in alternatives on behalf of their clients. These platforms are built for the wealth management channel specifically, and don’t allow individual investor account access.

At Monark, we fall under the category of emerging exchange infrastructure, as our main value-add is to apply exchange technology and regulatory frameworks to facilitate liquid secondary trading. Technology advancements in private markets custody, transfer and settlement will also be key to centralizing open trading venues in private markets. Over the long term, the value add of exchange technology is in both improving technology offerings and fostering a network effect of liquidity. The players most successful in creating the network effect of liquidity through partnerships and innovative product offerings, will ultimately take the lead in setting industry level market infrastructure and standards.

As interest in private markets grows and investors increase allocation to alternatives, innovation is needed in a few key areas to create a central and open marketplace infrastructure that resembles public markets. Bain defines this end goal as, “Industry-level market infrastructure and standards. In this open architecture model, separate parties provide trading, settlement/clearing, and transfer/registry for private assets, akin to public market infrastructure.” In order to achieve this vision of an open marketplace we have identified five elements ripe for growth and innovation in private markets today.

Adoption of new technologies and regulatory frameworks from both supply and demand side stakeholders

Liquidity providers and market makers participation in central trading venues

Open access to data, information and investor tools for valuation and diligence

Partnerships and cooperation between platforms will be key to medium term growth and adoption of central trading infrastructure

Brokerage driven solutions to access private market securities

Private markets today are guarded by two management layers, which have historically been necessary to mitigate the problems of access, availability of investment data, expertise, and lack of technology infrastructure in the alts space. Investors seeking access to private markets often do so through both the wealth management/advisory layer, and the asset management layer, with both management layers taking service fees away from the returns of the underlying asset. Private market investing is also heavily dependent on relationships, as wealth managers work on behalf of their clients to seek out access to the best fund/asset managers. Finding the right wealth manager, who in turn has the right relationship with asset managers, is often the best course of action for mid to high-net-worth investors to allocate to alternatives today. Simultaneously, investors seeking exposure to private markets on the individual asset level, typically need to have a pre-existing relationship with the GP. An example of this would be a private real estate GP seeking LPs for their deal, tapping their network and relationships to find LPs to invest in their offering. On the individual asset level, technology platforms like Yieldstreet and Cadre have emerged to increase exposure for GPs and bring new LPs into deals through an online distribution platform. As innovative technologies remove the necessity of the wealth management layer and create open marketplace solutions for individual investors, brokerage platforms like Schwab and Merrill will be forced to partner with or build solutions for individual investor access to private market alternatives.

The explosion of activity in the pre-IPO asset class, with ATS offerings from platforms like Forge, EquityZen and Linqto, show the potential for increase in trading activity and liquidity when data on a specific asset class becomes widely available. Individual accredited investors can now access the pre-IPO asset class without the wealth management/advisory layer. Data providers like Caplight have aggregated broker dealer trade data into a central database and provide access to that data through API integration. One factor driving the increase in data transparency is the alignment in incentives between pre-IPO shareholders and new investors seeking access to the asset class. As the public IPO market remains shuttered, existing shareholders in pre-IPO companies who expected liquidity through a public exit, are now actively seeking an early exit from their investment. Similar incentives exist in other private market asset classes, with commercial real estate in particular seeing a massive increase in near term demand for early exits. The participation of market making firms in some of the larger ATS platforms that trade in pre-IPO assets will serve as final proof of the development of an open exchange infrastructure for the pre-IPO asset class specifically. The combination of incentive alignment between buyers and sellers, emerging exchange technology, and access to accurate and widely distributed data, has allowed for the development of a liquid and active trading market in the pre-IPO asset class.

As access to private market investing grows in popularity, the rise of platforms will be instrumental to increasing access, distributing information and pooling liquidity. iCapital has accelerated growth in access to private markets for the wealth management channel in particular, catering to the high-net-worth end-user who prefers to invest through their wealth manager. iCapital has shown the power of partnerships, working with many of the largest asset managers, broker dealers and bulge bracket banks, providing wealth advisory clients at those institutions with access to private market trading infrastructure. A number of direct to consumer facing platforms like Yieldstreet and Cadre have made huge strides in offering individual investors access to alternatives, through both pooled and single asset investment vehicles. Monark is focused on bridging the gap between individual brokerage accounts at platforms like Scwhab and E*Trade and asset offerings from platforms like Yieldstreet, creating a network effect of liquidity at the individual investor level, much like iCapital has done for the wealth management channel.

It is our view at Monark that private markets are transitioning from Wave 1 to Wave 2 of development. Platform partnerships will likely increase in size and scope, as the wealth management/advisory layer continues to provide investors access to the best alternative investing strategies. As we move towards Wave 3, and the emergence of a more open exchange infrastructure, we expect incentives to align more towards facilitating individual investor access to private market funds and assets. Much of this demand for innovation will be driven by adoption from brokerage platforms of open exchange infrastructures. The innovation itself will be driven by technology platforms that seek to partner with brokerages, asset managers and ultimately individual investors to facilitate access to private market alternatives in a streamlined manner.